#1040 form 2020 software

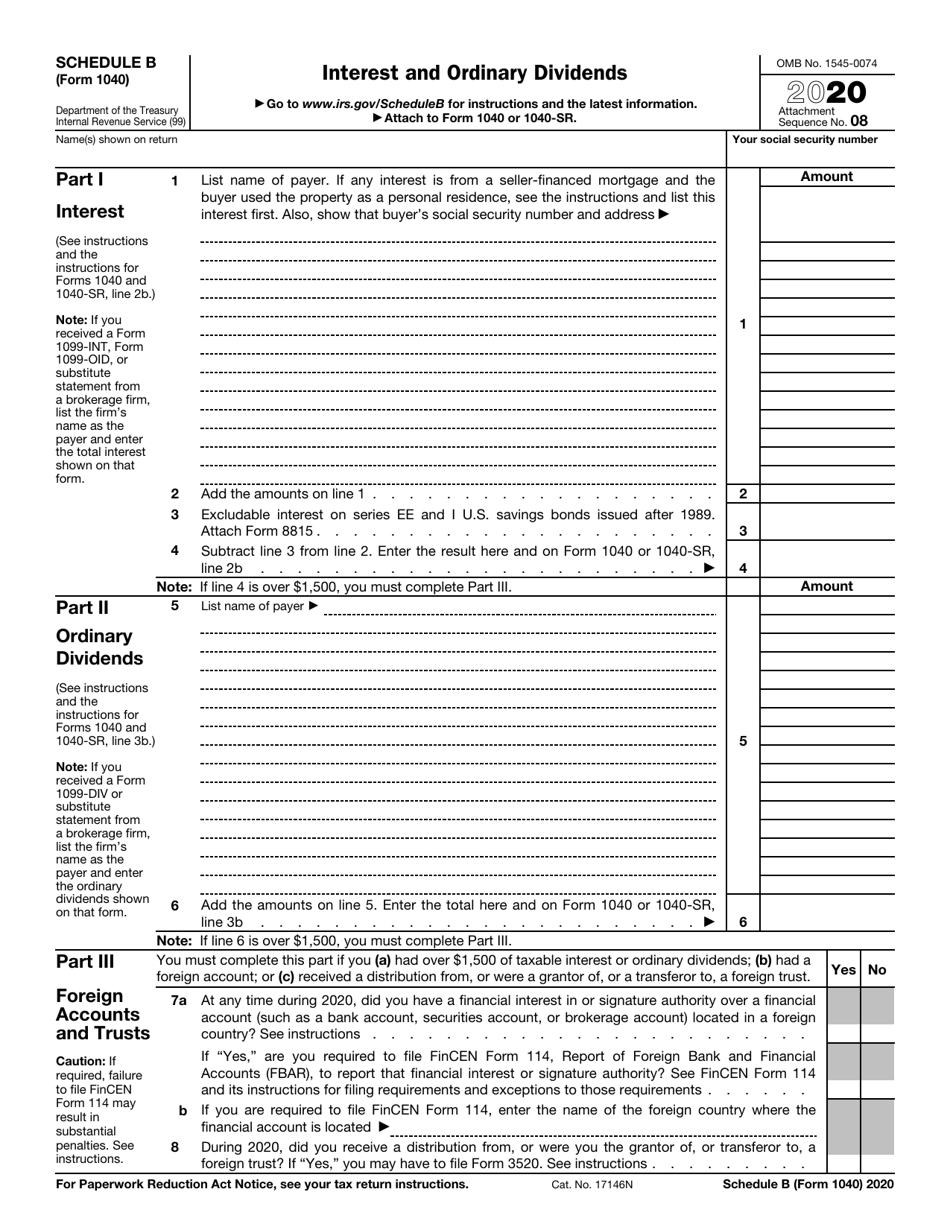

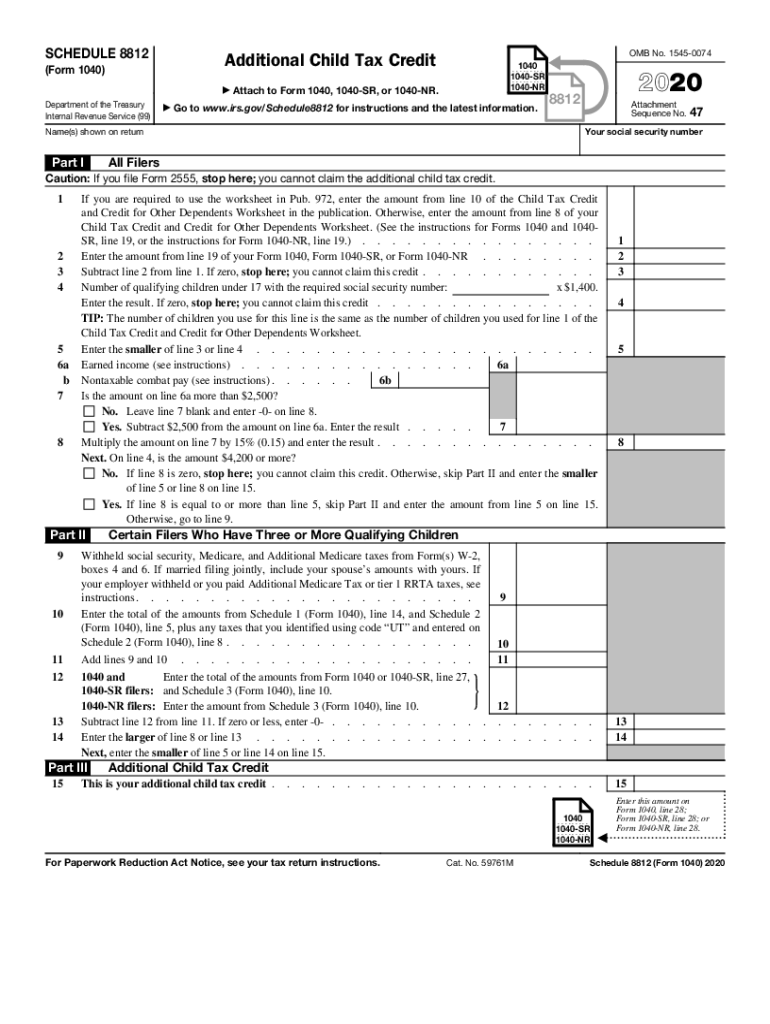

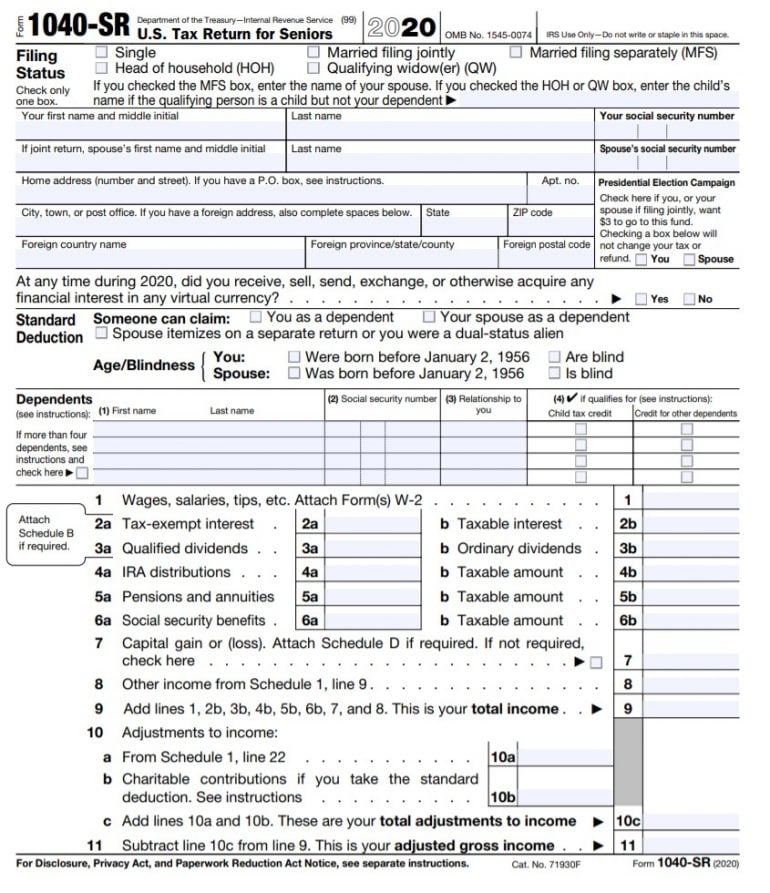

In many cases, if you’ve used tax software to e-file previous tax returns, your AGI will automatically be entered into the filing information for your current year return. When self-preparing your tax return to file electronically, the IRS uses your adjusted gross income or your prior-year Self-Select PIN to validate your identity and your electronic tax return. Why do I need to know my AGI to e-file my tax return? Depending on your filing status, you may be subject to a limit on your deductions based on your AGI which usually applies to higher income earners. That’s especially important because deductions and credits can increase your tax refund or reduce the amount of taxes you owe. In addition to being used to verifying your identity, your AGI impacts many of the tax deductions and credits you can take at tax time. Instructions for Form 1040 and Form 1040-SR have a complete list of all eligible adjustments.Īfter subtracting your adjustments from your total income earned, you’ll get your AGI, which will be reported on line 11 of Form 1040. Health savings account (HSA) contributions.Certain business expenses for self-employed workers.Alimony from an ex-spouse (for agreements prior to 2019)ĪGI doesn't include your standard or itemized tax deductions, so set those aside to figure into your taxable income later.Īfter calculating your total income, the next step is subtracting any adjustments.

When calculating your adjusted gross income, you’ll need to consider all of your sources of income, including: The IRS defines AGI as "gross income minus adjustments to income." Depending on the adjustments you’re allowed, your AGI will be equal to or less than the total amount of income or earnings you made for the tax year. How do you calculate your adjusted gross income? TurboTax Tip: If you used TurboTax, read this helpful FAQ on where to find last year’s AGI to verify your identity for this year’s tax return. If you used TurboTax, read this helpful FAQ on where to find last year’s AGI to verify your identity.

#1040 form 2020 download

If you used online tax software, you can typically login and download a copy of your prior year’s 1040 tax return to find your AGI. You can find the name of your tax form on the upper left hand corner of your return. Line 4 on Form 1040EZ (tax years before 2018).

#1040 form 2020 how to

It’s important to know how to find your AGI on your tax return because it’s used to determine your income tax liability. Where do you find your AGI on your tax return? Gross income includes your wages, capital gains, retirement distributions, dividends, and any other form of income.Īs you prepare your tax return, it’s important to note that your AGI will never total more than your Gross Total Income. When filing your taxes, you may wonder, “what is my AGI?” Adjusted gross income is your gross income minus any adjustments to your income, such as student loan interest, alimony payments, or retirement account contributions. Your AGI often impacts the tax breaks you’re eligible for.It is located on different lines on forms from earlier years. Your adjusted gross income (AGI) consists of the total amount of income and earnings you made for the tax year minus certain adjustments to income.If you e-file, the IRS may ask for your AGI from last year’s return in order to verify your identity.

For those who are filing prior year returns, you can continue to use form 1040A or EZ for tax years through 2017. They have been replaced with new 10-SR forms. For tax years beginning 2018, the 1040A and EZ forms are no longer available.

0 kommentar(er)

0 kommentar(er)